5 Steps To Protect Your Family Financially

When you become a parent your mindset and your priorities change.

Suddenly, you are the 2nd most important person in the world.

As a parent, you’d give your last bite to make sure your child was fed.

You’d break your budget just to make sure they had whatever’s needed to get by.

At least, that’s how I feel.

Myself, I have two under two - a little boy and a little girl. Like any loving parent, if it came down to it I’d sacrifice it all for my babies. No questions asked.

BUT, hopefully, it will never come to that.

The goal of this article is to make sure that you never have to make any drastic sacrifices like that for your family either.

Finding Your Financial Balance

Life as a new parent is hard enough as it is. No need to further complicate the situation with unneeded financial frustration.

Of course, everyone’s circumstance is unique. Some people simply don’t have the means to provide everything they want to - And that’s okay!

Just start where you are with what you have and do what you can.

On that note…

Here are 5 steps to solidify your financial situation and make sure your family won’t have to worry about money every month.

5 Financial Priorities For Parents

Get Your Emergency Fund Ready

As soon as kids enter the picture, it’s time to get serious about your money.

People are counting on you, so as much as you can help it, you need to do everything you can to build some stability into your life.

Track Your Spending

Start by getting an idea of how much money you are spending each month. I always recommend using the free website & mobile app called “Mint”.

Mint will track and categorize all of your spending for you automatically.

Using systems to automate time-consuming tasks like tallying expenses is a must! New parents don’t have time to waste totalling up all their receipts.

Don’t do it yourself - Use technology.

Once you know how much you are spending each month (on average), then you need to sort out the essential expenses from your leisure luxury.

Then, take the amount you spend on essentials every month and multiply that amount 3 times. Minimum.

Now you have a 3-month emergency fund.

When you bring a child into the picture, that emergency fund needs to be a little bit stronger than it was when you were only fending for yourself.

If you have the capacity, consider working towards a 6-9 month emergency fund eventually. This will give you more room to work if things ever take a turn for the worst where your income is concerned.

Buy Life Insurance

Life insurance doesn’t make sense for everybody, but once you have children it’s a good idea to look into it.

There are two main types of life insurance: term insurance & permanent insurance.

Entire books could be written on the pros and cons of each type of insurance, so I won’t get too granular in this article. However, these are the basics that you need to know.

Term Insurance vs Permanent Insurance

Term life insurance covers you for a certain period of time. Permanent life insurance covers you for… (Yup, you guessed it!)… your whole life.

Since permanent life insurance never expires, it generally costs much more than term insurance.

Premiums (the fancy term for monthly payments) often 5x to 10x more for a similar amount of coverage.

Both term and “perm” insurance are paid for with after-tax dollars. As a result, the “death benefit” is paid to your beneficiary 100% tax-free.

That means a $100,000 insurance policy pays out $100,000.

No income tax. No probate. No government intervention.

For this reason, many affluent families use insurance as a tax shelter. While it is seriously more costly upfront, for those who can afford it, permanent insurance can be a good way to transfer wealth from one generation to the next without paying any taxes.

Most People Buy Term Insurance

Term insurance is specifically designed to replace your income, support your family, and cover your final expenses if the unthinkable happens and you pass away unexpectedly.

Term life insurance comes in a variety of lengths - Usually 10 years, 20 Years, or 30 years.

When shopping for a policy, your insurance agent will help you choose a term length that aligns with some major financial obligation. For example, you might buy insurance that lasts until your mortgage is paid off or your youngest child finishes college.

In either case, the insurance is no longer needed once the financial obligation (mortgage or tuition payments) is gone.

You May Already Have Life Insurance Without Knowing It

A lot of companies offer some form of basic life insurance as a part of their group benefits plan.

Usually, the cost of this group life insurance is baked into the total cost of benefit enrolment, so you might not even know that you have it if you were daydreaming during those super long orientation meetings during your first week on the job. You can always send an email to your HR department and ask them. They will know.

Group Life Insurance

Group life insurance can be slightly different than a policy that you would go out and get on your own.

Generally, the base group insurance policy is going to pay out 1 year’s worth of your salary or somewhere thereabouts. Of course, anything is better than nothing, but you may need more coverage to fully cover the potential financial burned of your early passing.

🙄 So, I hate to do it to you, but I have to ask…

If you died today how would it affect your family financially? Get with a licensed life insurance agent to do a thorough financial needs analysis.

If you’re the glue that keeps everything together in your household, make sure you have a plan so that things don’t fall apart if you ever leave the picture.

Open An Investing Account For Your Kids

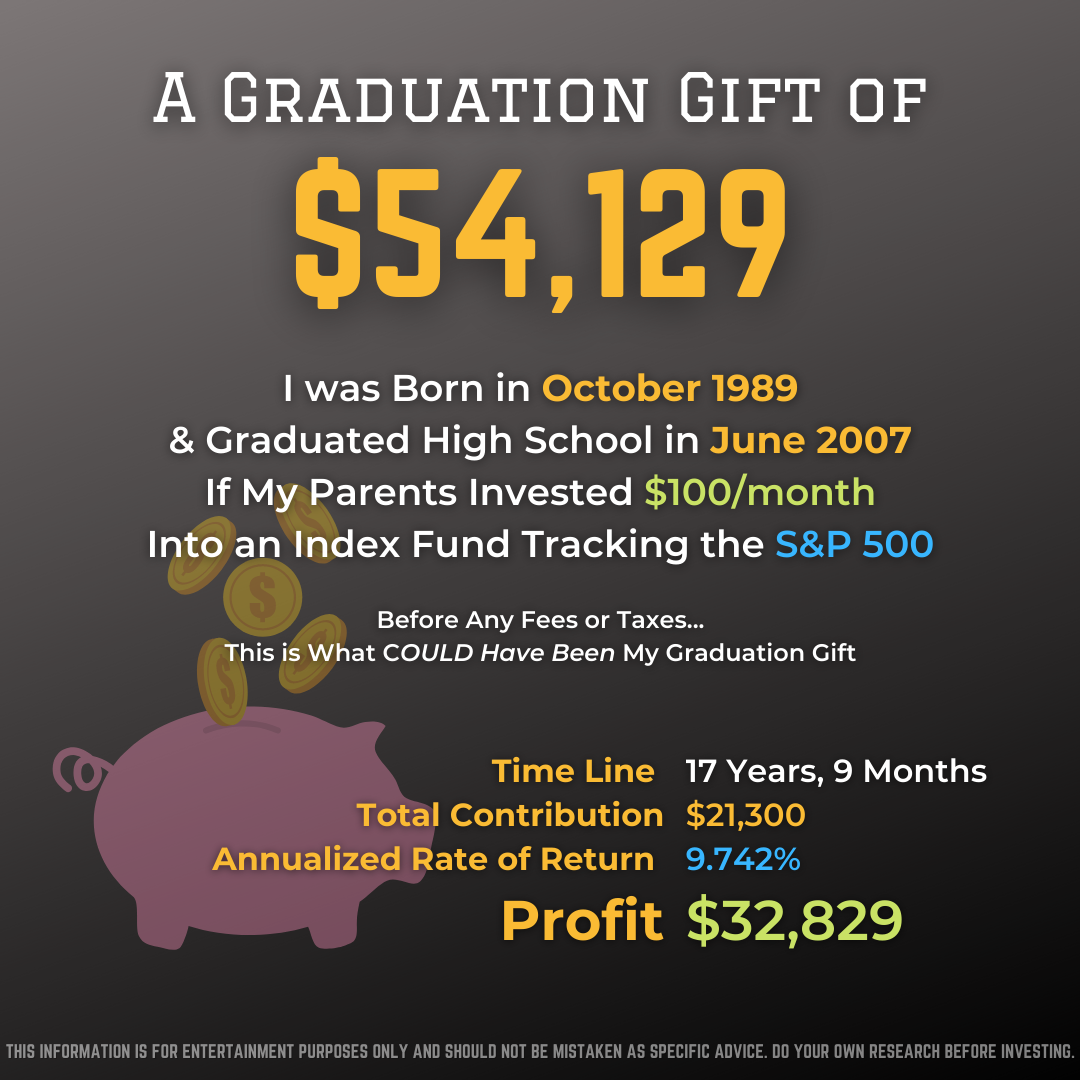

As an investor, the greatest ally you will ever have is time.

When you can get your kids in the stock market early, you will give them a game-changing advantage over all of their peers.

Longer time horizons allow investors to enjoy the money magnifying effects of compounding returns.

Since they will be invested for decades to come, there is no pressure to speculate on “the next big thing” and take on unnecessary amounts of risk.

In fact, steady gains from reliable, industry-leading companies are all you need to stack some major bread.

Better yet, you can do just fine without having to pick any companies at all.

Simply, dollar cost average into an index matching ETF every month.

Read my article about the $50,000 graduation gift and you will see just how powerful this index investing strategy can be.

Update Your Beneficiaries

Over the years, you’ve probably opened accounts with different banks, investment brokerages, and insurance companies.

You may have a retirement account with your current employer and an old pension plan from a previous job that you’re not contributing to anymore. Maybe you have multiple savings accounts.

Whether you have 2 accounts or 10 accounts, you need to document where your money is.

I use a spreadsheet to track my money. Every bank account, investment account, and insurance plan in my name.

These are the columns I list across the top of the spreadsheet:

Institution name

Account or Policy number

Beneficiary

Phone Number

Notes

Keep the passwords to access this info in a location where your significant other can get to it in an emergency.

Once you have a list, call each of those banks, brokerages, or insurance companies up and make sure that they have your most current contact information. You don’t want them sending any important announcements to an old mailing address.

More importantly, make sure to update your primary and secondary beneficiaries on each account and insurance policy.

If your relationship status has changed or you have had children since you last updated the account, it will be important for you to go through this process.

Again, this is about making things easy on your family should the unthinkable ever happen.

Write Your Will

You can get a will done online for less than $100.

That being said, for something as important as making sure that the right people become the guardians of your children, I would pay the extra couple hundred dollars to have a lawyer draft the proper documents for you.

The added expense is less about what it costs to get it done and more about what it would cost if it were done incorrectly.

Your will includes answers to questions such as:

In the event of your death, who would become the legal guardian(s) of your children?

Do you want your house to be sold or passed onto someone else?

Who gets your jewellery?

What should happen to your cars?

How will your investments be split up among your family?

Do you want to leave anything to charity?

Needless to say, these are some decisions that you are going to want to think about well in advance.

Summary

Obviously, having kids comes with a lot of new responsibilities. But if you cross your Ts & dot your Is, you can take your mind off of the finances and focus on your family. As soon as you can, make sure to:

Build an emergency fund

Look into life insurance

Set up an investment account for your kids

Double-check the beneficiaries on all of your accounts, &

Have a formal will drawn up to protect your family and your estate.

If you know a parent, please share this article with them. They might thank you for it. And if there’s anything I missed, let me know in the comments section.