4 Reasons to Start Saving and Invest ASAP

True wealth is having the power to decide what you want to do with your time.

Growing up I always admired pro athletes and wealthy business people. It was easy to be drawn in by the allure of exotic cars and lavish homes, but as I got older I realized that the most appealing aspect of that superstar lifestyle wasn’t the money it was the freedom.

Luckily, you don’t have to be a millionaire to be wealthy.

Wealth is a Lifestyle, Not a Number

Ramit Sethi, a popular money blogger, says that a rich life is one in which you can spend (guilt-free) on the things you love because you’ve cut back mercilessly everywhere else. Whether you agree with this definition of a rich life or not, he does make a good point.

Everything is a trade-off. You just have to decide what is worth trading.

Personally, I’d rather sacrifice modestly now so that I can have much more later.

BOOK: Admittedly, the title of this book is brash, but I promise I Will Teach You To Be Rich by Ramit Sethi is one of the best personal finance books available in 2020. (And if you use this link to get your physical, Kindle, or audio copy of the book you will be supporting my blog - so thanks in advance! 📚)

No matter what your “rich life” looks like, financial independence can be achieved through lifestyle choices that favour long-term success over immediate gratification and overextension.

The earlier you can establish a strong financial position, the more decisions you will be able to make later based on preference rather than absolute necessity.

4 Reasons To Start Saving & Investing As Soon As Possible

Based on my experience, my research, and lessons I’ve learned from mentors, here are four reasons why I am focussed on accumulating marathon money.

Small Moves Create Big Wins

Investing early maximizes the multiplying power of compound interest.

Compound Interest: A virtuous cycle wherein the money you make from investing continues working to make additional money.

Here’s a quick example.

Assume you invest $1,000 in the year 2020 and that money grows at an interest rate of 10%. After one year, your original $1,000 would have grown to $1,100.

Then the magic happens

Now, it’s 2021 and you have $1,100 in your investment account. How much money will you have if you leave your money to grow for one more year?

Since your money is still growing at a rate of 10% year-over-year, instead of gaining $100 again by 2022, this time you gain $110!

🧐 Why?

The interested that you made in year one is helping generate more interest in year two!

Here is a breakdown of how your initial $1,000 would grow in 15 to 25 years (without adding any additional money of your own) if you were able to get a consistent 10% return on your money.

Year 1 - $1,000

Year 2 - $1,100

Year 3 - $1,210

Year 4 - $1,331

Year 5 - $1,464.10

Year 6 - $1,610.51

Year 7 - $1,771.56

Year 8 - $1,948.72

Year 9 - $2,143.59

Year 10 - $2,357.95

…

Year 15 - $3,797.50

…

Year 20 - $6,115.91

…

Year 25 - $9,849.73

In this example, we turned $1k into almost $10k simply by keeping our money in the right place.

Small move, big win.

Compound interest is the mathematical magic that can turn a modest amount into a serious sum of money. Take advantage!

If you don’t think these numbers are real, try them for yourself. Search Google for an “interest calculator” and plug in your own numbers. Simply seeing the possibilities could be enough motivation to get you started.

Slow Money is Easy Money

Just like spending, saving and investing are habits.

When it comes to money habits you have two choices - You can begin to form positive habits now, or you can struggle to break bad habits later.

As we saw in the compound interest example, the earlier you start saving and investing the easier it is to accumulate large amounts over time.

Oddly enough, the real financial pitfalls that most young people hit are not income issues. They’re mindset issues.

As a student or recent graduate, chances are that you’re not making a huge salary. If you don’t have a ton of money coming in it can be daunting to even think about saving, so we don’t even bother.

Limiting beliefs like this are dangerous because they don’t just affect you now, but they affect your future self and your future family.

If $88 per month ($1,056 / year) is a lot for you right now, then find out what is manageable and start with that.

How about $20 per month?

Could you save $5 per week?

Maybe save the change from your daily lunch?

The point isn’t to get rich saving pocket change. The point is to build a habit of paying yourself first so building wealth becomes easy.

Once you get used to putting money in a safe place on a regular basis, then it will be much easier to save bigger chunks of money later when you finally increase your ability to earn a greater income.

Finding ways to get your money up quickly is really tough. That’s why so few people actually get rich quick. Paying yourself first, on the other hand, can be surprisingly easy. You just have to start small and stay committed.

MUST READ: The Automatic Millionaire by David Bach lays out a step-by-step process that you can use to build bullet-proof money habits without the need for strict discipline or willpower. This is one of my all-time favourite books.

Big Expenses are Predictable

As you get older life will inevitably get more expensive. Instead of waiting for life to hit you all at once - Get prepared!

When you plan ahead you give yourself more options and expose yourself to less debt.

Not everyone will do all of these things, but here’s a short list of major expenses that you might want to think about planning for a few (or many) years in advance.

Buying a car

Buying a house

Travelling the world

Having kids

Sending your kids to school

Retiring

Yes, different types of accounts are better for different saving and investing goals, but that’s not what we are here to talk about today.

The main point here is to look ahead at what you want to do down the road and start preparing for it today. Don’t just plan for tomorrow, plan for many tomorrows.

Keep More of What You Earn

By learning how taxes work you can make informed decisions about where to keep your money and how to move your money in order to reduce your tax burden now and in the future.

In Canada, we pay taxes to the federal government and the provincial government. The amount of tax you owe is based on a “graduated” system. That means your first dollar earned and your last dollar earned are not necessarily taxed at the same rate.

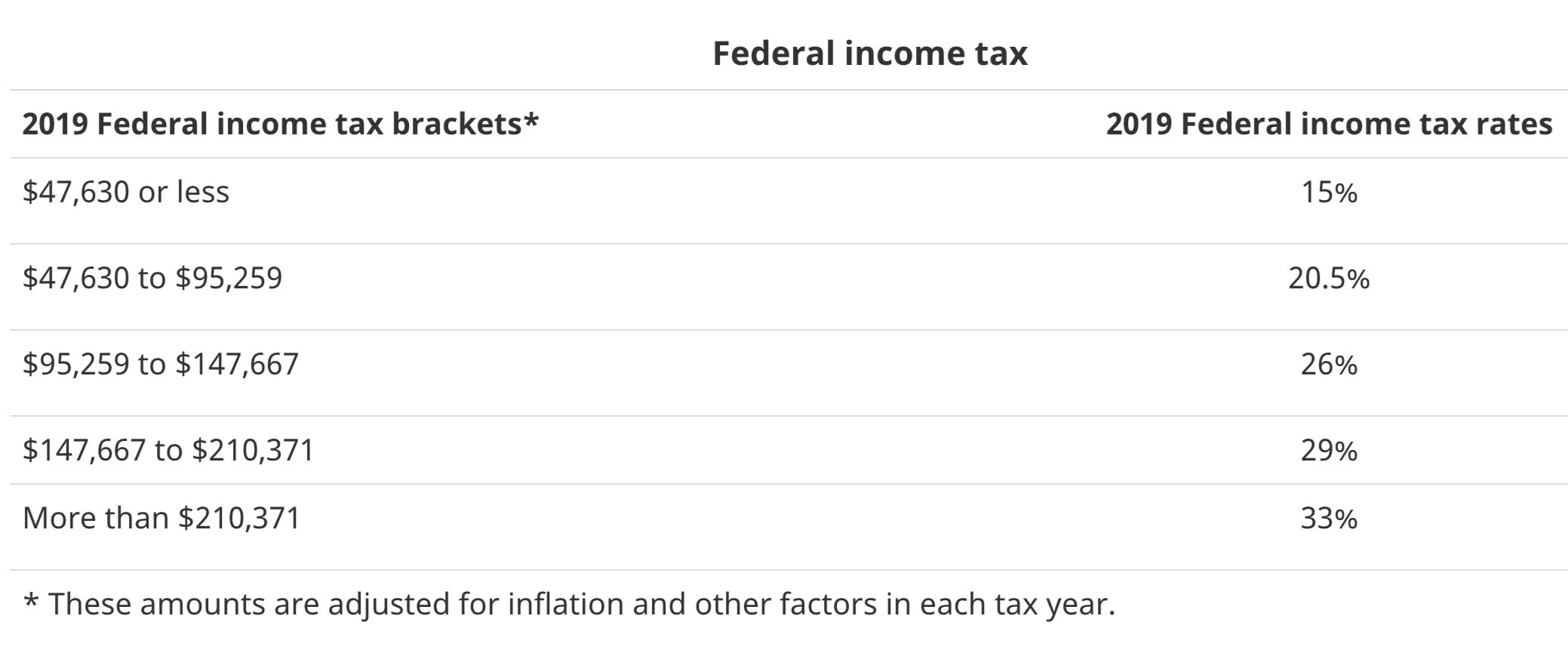

For a better explanation, let’s take a look at the federal tax brackets from 2019 according to the Canada.ca website.

The chart above shows how each dollar you earn is taxed differently. So, no matter how much total money you earn, the federal government is going to take 15% of the first $47,630. Then, they would take 20.5% of the amount you earned between $47,630 to $95,259.

Here is the example they use on Canada.ca …

Example: If your taxable income was $50,000 in 2019, you would calculate your federal tax as follows:

Pay 15% on the amount up to $47,630, or $7,145.00

Pay 20.5% on the amount between $47,630 to $95,259, or $485.85

Total federal tax payable: $7,630.85.

(Tax brackets & percentages accurate for tax year 2019 and are used as examples only.)

So, now you know the basics of how income taxes are calculated.

With that in mind, here is just one of the many tactics that I’ve used to minimize my lifetime tax expense.

*DISCLAIMER: I am not your accountant or financial planner. These are hypothetical scenarios loosely based on my personal experience that I am sharing for entertainment purposes only. Always talk to a qualified professional to get the best advice for your personal situation before you make any real money moves. Everybody’s situation is different. That’s why it’s called personal finance. Now, back to the blog...

RRSPs

Here’s something I learned from my time playing professional football in the Canadian Football League.

When you’re in a higher-tax bracket you need to take full advantage. You are not guaranteed to make a high income forever.

If you can make substantial RRSP contributions, doing so will give you two benefits.

Initially, money put into an RRSP (or a similar tax-deferred investment vehicle) will reduce your taxable income for the year.

Example: If I make $120,000 before taxes and put $10k in an RRSP, the government can only tax my income as if I made $110,000. A reduced tax bill means I keep more of what I earned. This is why contributing to your RRSP can often lead to a nice little rebate at tax time.

Additionally, once you start withdrawing from your nest egg during retirement, there is a good chance that you will be in a lower tax bracket than you were in your prime earning years. For example…

When I retire, if my (hypothetical) annual income is reduced from $120k to $40k per year, then the initial $10k investment I made in the above example would only be taxed at 15% in retirement instead of 26% during the peak of my career.

So, just by putting my money in a RRSP during my prime earning years I would be able to save an addition 11% of federal taxes on my original $10k investment.

That’s $1,100 more in your pocket, for free!

Final Word

A few years back, I remember standing on my driveway talking to my neighbour about real estate. That day he said something that’s stayed with me ever since.

He said “Courtney, I’ve made it to a point in my life where today is taken care of. Now, I’m planning for the future. I want the financial decisions I make for myself to have an impact on my family 100 years from now.”

None of us will live to see the impact of our decisions in 100 years, but the idea has always stuck with me.

Do whatever you need to do today so that you can start thinking about your tomorrows. That’s how you create true wealth that lasts long after you’re gone.